county tax liens nj

In fact the rate of return on property tax liens investments in Camden County NJ can be anywhere between 15 and 25 interest. Construction Lien Claims - 1500 for the first page 5 each additional page.

How Much Do You Need To Make To Buy A Home In Barnegat Home Buying Real Estate Education States

Bergen County NJ currently has 4168 tax liens available as of March 17.

. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. Its purpose is to give official notice that liens or judgments exist. 2022 notice of sale for non-payment.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus. Tax Collectors Office Township of Teaneck 818 Teaneck Road Teaneck NJ 07666. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien certificates greater than 10000 a 6 penalty is added. Ad Buy Tax Delinquent Homes and Save Up to 50. Burlington County NJ currently has 7432 tax liens available as of February 28.

The tax sale certificate that is issued is the detailed receipt of what the lien holder purchased at the tax sale. In fact the rate of return on property tax liens investments in Middlesex County NJ can be anywhere between 15 and 25 interest. In fact the rate of return on property tax liens investments in Ocean County NJ can be anywhere between 15 and 25 interest.

Any interested parties please send a self-addressed stamped envelope requesting for a tax sale list when it becomes available to. CODs are filed to secure tax debt and to protect the interests of all taxpayers. Investing in tax liens in Middlesex County NJ is one of the least publicized but safest ways to make money in real estate.

The certificate must be held for two years from the date of sale before the. Submit the official document in person or via mail to PO Box 690 Newark NJ 07101-0690. Investing in tax liens in union county nj is one of the least publicized but safest ways to make money in real estate.

In New Jersey the County Tax Collector will sell Tax Lien Certificates to winning bidders at the Bergen County Tax Lien Certificates sale. HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Investing in tax liens in Mercer County NJ is one of the least publicized but safest ways to make money in real estate.

Tax sale liens are obtained through a bidding process. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Camden County NJ at tax lien auctions or online distressed asset sales. According to state law New Jersey Tax Lien Certificates can earn as much as 18 per annum 4 - 6 on the amount winning bidders pay to purchase New Jersey Tax Lien Certificates.

Some municipalities include an additional 6 year end penalty on tax lien certificates. A tax lien is filed against you with the Clerk of the New Jersey Superior Court. Martin Luther King Jr Blvd Room 230 Newark NJ 07102 Together we make Essex County work.

All liens must be against Essex County residents or property. What it will cost. Bergen County New Jersey Delinquent Tax Sale.

Investing in tax liens in Ocean County NJ is one of the least publicized but safest ways to make money in real estate. Should any member of the public wish to attendlisten to the board meeting the call in number is 201-336-6626 and the access code is 8809. See Available Property Records Liens Owner Info More.

Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. The certificate is then auctioned off in ocean county nj. In New Jersey as in other states property owners are legally required to pay property taxes on their holdings and to pay other municipal charges for which they may be liable such as sewer and water charges special assessments or liens for abating nuisances such as boarding or removing debris from the grounds of a property.

Essex County Tax Board 495 Dr. Clear title cannot be issued for a property with recorded liens on it. Investing in tax liens in Camden County NJ is one of the least publicized but safest ways to make money in real estate.

In fact the rate of return on property tax liens investments in Bergen County NJ can be anywhere between 15 and 25 interest. Search Any Address 2. A judgment entered in court that is available for public view.

This includes deeds mortgages liens judgements lis pendens discharges notices of settlement maps and other related documents. Camden County NJ currently has 23845 tax liens available as of February 21. Hospital and Physician Liens - 15.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Burlington County NJ at tax lien auctions or online distressed asset sales. Investing in tax liens in Bergen County NJ is one of the least publicized but safest ways to make money in real estate. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Bergen County NJ at tax lien auctions or online distressed asset sales.

The lien holder will receive a legal document referred to as a tax certificate that must be recorded with the Essex County Hall of Records. This website has been designed to provide property owners and real estate related professionals with a variety of information concerning the Ad Valorem tax process property tax assessment process. In fact the rate of return on property tax liens investments in Mercer County NJ can be anywhere between 15 and 25 interest.

In order to comply with the Open Public Meetings Act the Bergen County Board of Taxation will hold their March 2nd Board Meeting 930 am via teleconference call. 2021 Tax Appeal Deliberations. What you must do.

Abstract of Judgments - 2500. Register for 1 to See All Listings Online.

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

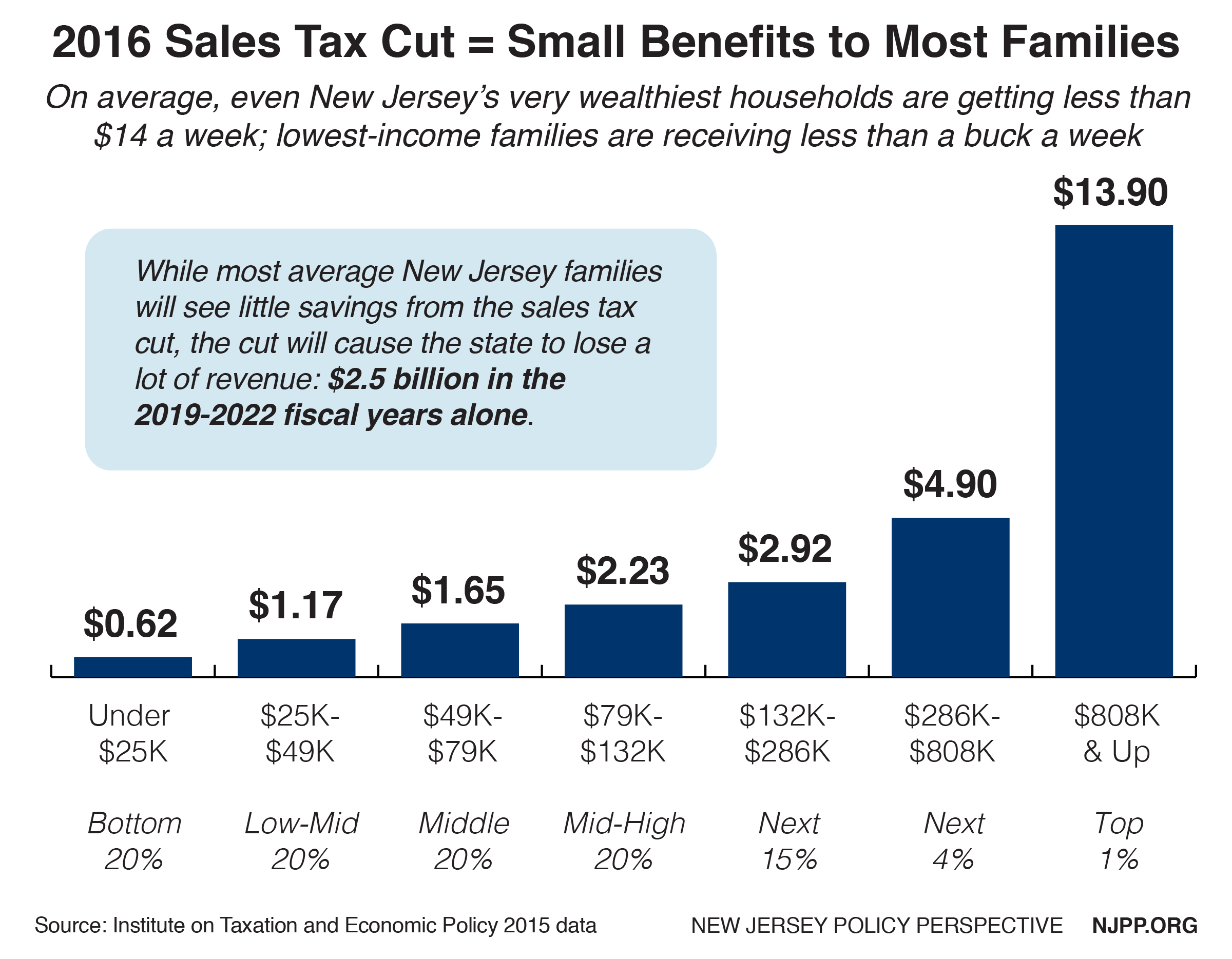

New Jersey Sales Tax Small Business Guide Truic

Understanding Nj Tax Lien Foreclosure Westmarq

Profiting On Hud Properties Tax Lien Investing Investing Real Estate Investing Free Webinar

Tax Collection Franklin Lakes Nj

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Busting The Myth The Real Numbers Show N J Is Not The Most Overtaxed State In The Nation Nj Com

The Ten Lowest Property Tax Towns In Nj

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

Tax Collection Moorestown Township Nj Official Website

New Jersey Tax Lien Certificates Deal Of The Week Franklin Nj Youtube

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Is New Jersey A Tax Lien Or Tax Deed State Tax Lien Certificates And Tax Deed Authority Ted Thomas

State Of New Jersey Sales Tax Rate Off 60 Yaren Com

Appropriation Of Taxes Millville Nj Official Website

Editorial New Jersey Property Tax Penalty System Allows Municipalities Investors To Charge 18 Interest Nj Com