child tax credit 2021 portal

COVID-19 Stimulus Checks for Individuals. Have been a US.

About The 2021 Expanded Child Tax Credit Payment Program

COVID Tax Tip 2021-101 July 14 2021.

. 1200 in April 2020. Individual Income Tax Attorney Occupational Tax Unified Gift and. IMPORTANT INFORMATION - the following tax types are now available in myconneCT.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Below is important information for anyone with children aged 18 and under. 3600 for children ages 5 and under at the end of 2021.

Having received monthly Child Tax Credit. This option is a good choice for people with lower incomes who want a quick and easy way to claim the Child Tax Credit and stimulus payments. A childs age determines the amount.

The new Child Tax Credit Update. For more information see Q B7 in Topic B. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. The IRS will pay 3600 per child to parents of young children up to age five. 3000 for children ages 6.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can.

Help with Payment Issues. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Half of the money will come as six monthly payments and half as a 2021 tax credit.

If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. 2 mins -- Starting July 15th families with. If you filed tax returns but have not received Child Tax Credit payments.

You need to file a 2021 tax return to claim the remaining 2021 Child Tax Credit. The CTC Update Portal and your IRS Online Account will have the correct amount. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

The Child Tax Credit does not affect your other Federal benefits. Department of Revenue Services. In addition to missing out on monthly Child Tax Credit payments in 2021 a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed.

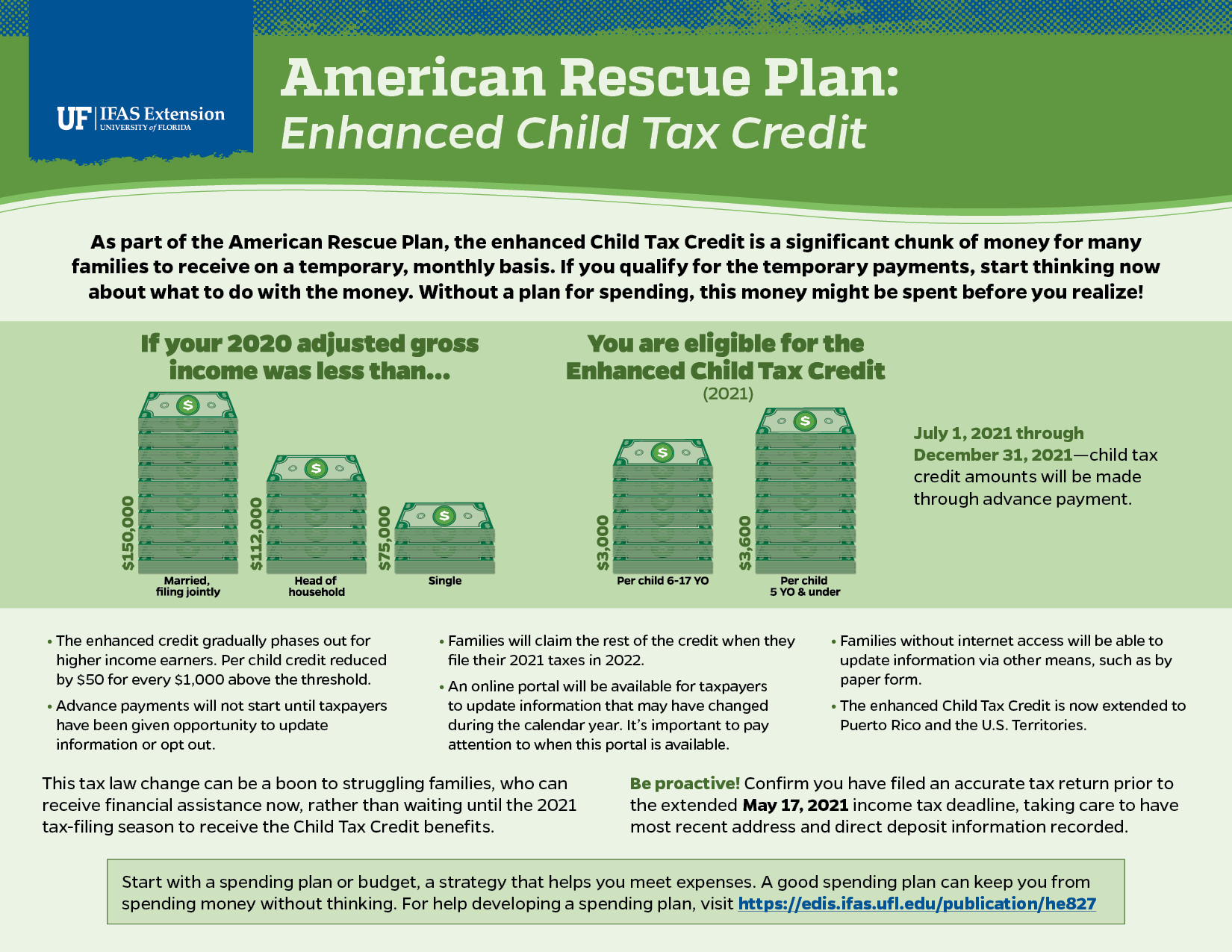

There are significant changes in 2021 to the Federal Child Tax Credit that were part of the American Rescue Plan. By Brittany Harrison Jul 1 2021 General Discussion Personal Finance Tax Tips Planning -- Read Time. Earning less than 12500 single or.

Child Tax Credit payments start July 15th. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. After that families can still claim the 2021 CTC but will need to file.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. For help filing a past.

For 2021 eligible parents or guardians.

Change Address On Child Tax Credit Update Portal Winkelman Bruce Truax Llp

White House Unveils Updated Child Tax Credit Portal For Eligible Families

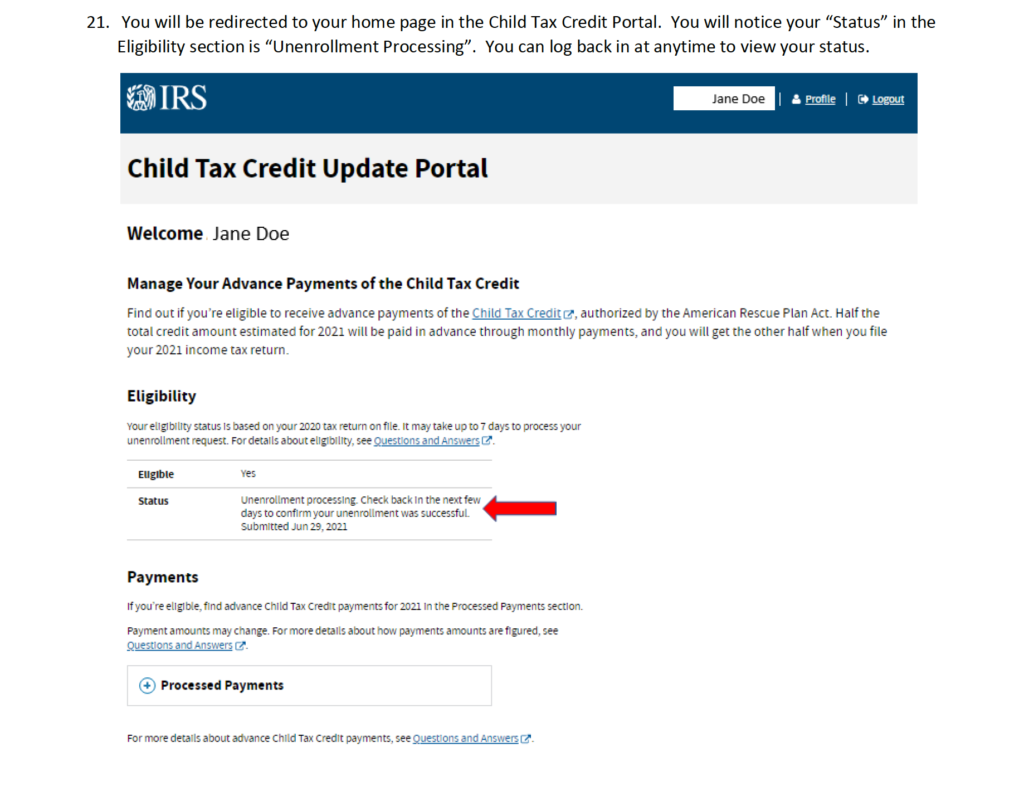

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

American Rescue Plan Enhanced Child Tax Credit Living Well In The Panhandle

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

New Expanded Monthly Child Tax Credit Maine Immigrants Rights Coalition

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

What Divorced Or Separated Parents Need To Know About Child Tax Credits Elmhurst Family Law Attorney

Income Update Feature Debuts Nov 1 On Irs Child Tax Credit Portal Don T Mess With Taxes

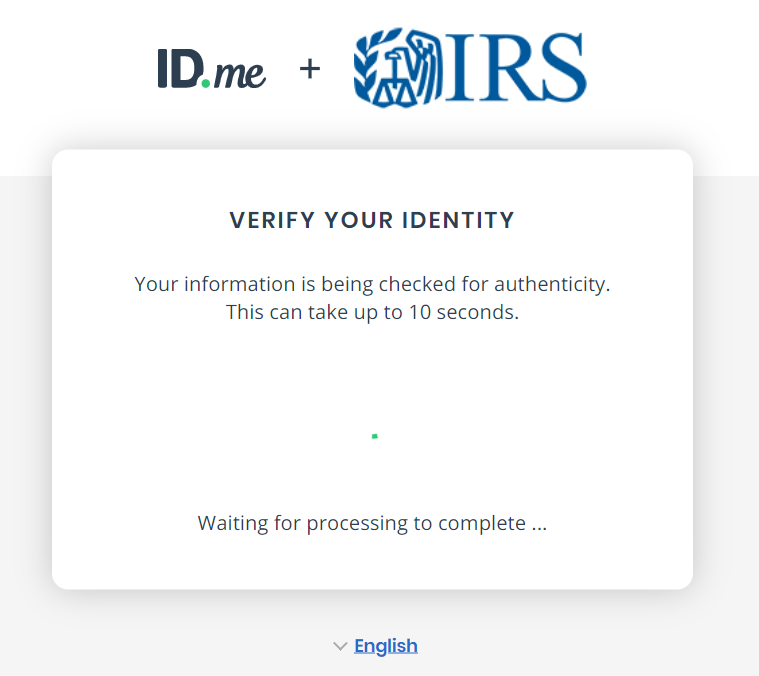

How To Access The Irs Child Tax Credit Update Portal Kindred Cpa

Child Tax Credit Portal How To Use The Irs Tool To Enroll For 2021 Nj Com

Need An Overview Of The 2021 Cnmi Office Of The Governor Facebook

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Accounting Aid Society Using The New Child Tax Credit Update Portal Families Can Now Unenroll From Advance Payments Meaning They Won T Get The Monthly Payments Set To Start July 15 And

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments